RBI requested to extend “Export Refinance Facility” to banks

FIEO President Dr A Sakthivel has advised Indian exporters to opt for foreign currency denominated credit which is available at LIBOR+150-200 basis points and provide a comfort, during the extreme volatility in dollar, without any hedging cost.

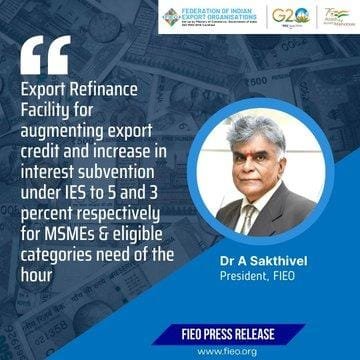

He has also requested RBI to extend “Export Refinance Facility” to banks. Under such a mechanism, banks may be encouraged to provide export credit in Rupee to exporters and the same amount can be refinanced by the RBI at the Repo Rate.

“Such a mechanism will bring down the interest cost for export credit providing much needed competitiveness to our exports amidst global headwinds,” he added.

Dr Sakthivel made the call in reaction as RBI’s Monetary Policy Committee (MPC) increased the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6.50% with immediate effect on 8 Feb 2023.

Consequently, the standing deposit facility (SDF) rate stands adjusted to 6.25% and the marginal standing facility (MSF) rate and the Bank Rate at 6.75%.

The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

FIEO Chief has also urged the Government to increase interest subvention under the Interest Equalization Scheme (IES) from 3% and 2%, respectively, to 5% (to all MSME manufacturers) and 3% (to all other eligible categories) as interest rates are at a much higher level than the pre-Covid times.

He also said that extending of tenure of Pre-shipment Credit in Foreign Currency (PCFC) from 180 days to 365 days will further provide headroom for the exporting community.

Separately, FICCI President Subhrakant Panda said, “The 25 bps hike in policy repo rate by the Reserve Bank is in line with expectations.

“While the inflation trajectory over the course of next year is expected to be below 6% and will be somewhat of a reprieve, there is an upside risk on account of geopolitical factors.

“Hence, the Central Bank is expected to remain cautious while focusing on the economy achieving its full potential.”

“We also welcome the guidelines for Regulated Entities on the broad framework for acceptance of green deposits and the disclosure framework on Climate-related Financial Risks.

Further, he noted the announcements pertaining to enhancing the scope of TReDS by providing insurance facility for invoice financing, permitting all entities and institutions undertaking factoring business to participate as financiers in TReDS, and permitting rediscounting of invoices. “Taken together, it should certainly enable better cash flows for MSMEs,” said Panda. fiinews.com